Go global faster.

With less risk.

Expanding into new countries used to mean 12+ months of legal setup, tax registration, and paperwork.

With TopSource, while you retain full operational control of the employee and their work. you can hire in days, not quarters, while we handle:

Hire & pay compliantly in 180 countries without an entity

Dedicated support from experts only a phone call away

Specialist hr advisory to guide global decision making

Dedicated hands on employee onboarding for the best employee experience

On demand access to legal & hr expertise to future proof your compliance

Single intuitive global employment dashboard & dedicated API for integrations

Customisable Employment Contracts

Every country has its own employment-law landscape. Rather than forcing you into a generic agreement, TopSource works with you to create employment contracts that reflect your business needs, while ensuring full legal compliance in each location.

Our experts help you tailor terms like notice periods, probation, working hours, confidentiality, and IP clauses — all aligned with local regulations.

You keep control over how your teams work, with the safety of compliant, locally optimized contracts.

Bespoke benefits.

Improve international talent attraction & retention

Employee experience matters. With TopSource, you have the freedom to define and customise benefits for every region, giving you the power to design attractive, locally relevant packages.

Work with our experts to benchmark & choose from a wide selection of benefit options — from health insurance and pension plans to wellness perks and paid leave. Our in-country specialists help you build the benefits mix that suits both your budget and your people — without compromising compliance.

24/5 Phone Support

Global employment raises complex questions — and sometimes you need answers fast. With TopSource, you get 24/5 phone support, so you can reach our in-country and regional experts during your business hours.

Whether you’re navigating local labour laws, finalising onboarding details, or resolving a payroll query, our team is just a call away. We don’t just provide a helpdesk — you get a dedicated partner who understands your expansion strategy.

You keep control over how your teams work, with the safety of compliant, locally optimized contracts.

More than an Employer of Record.Processes & support to accelerate growth.

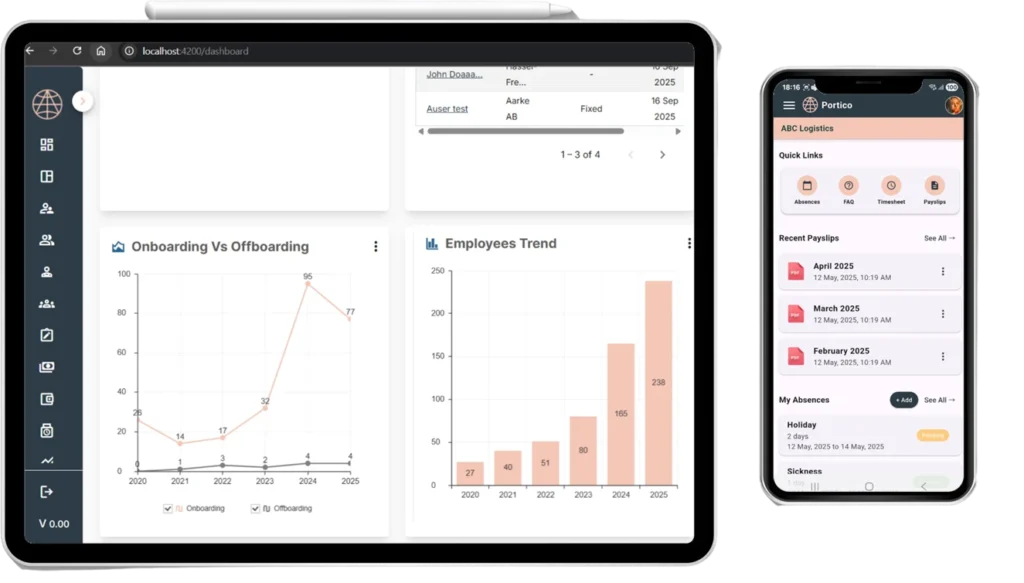

Platform

Global Employment Platform

Your intuitive hub for managing global teams. Simple, powerful, and designed to scale with you — no complexity, just clarity.

Audit

Find & eliminate barriers to growth

We proactively identify & sort out compliance issues across your global workforce whilst uncovering opportunities to improve profitability. On a quarterly basis we’ll audit your global talent strategy to ensure it aligns with your business goals.

Intelligence

Build a data driven talent strategy

Knowing who to hire, where to hire and how to operate helps you grow confidently and profitably. You can access the latest TopSource insights & data on hiring markets, salary benchmarking & benefits.

Advisory

Expert guidance for global clarity

Whether you’re managing a global acquisition or entering a new market, you get clear guidance to help you navigate complex decisions, avoid delays, and accelerate your global expansion.

Global Employee Cost Calculator

Estimate the cost of your new hire with our calculator. Simply enter their location and salary information in to this handy tool to see what will be spent in employment costs each month.

Employment Cost Calculator

*Indicative figures only and not definitive legal advice. Local regulations change frequently. Consult an expertUnited Kingdom

| British Pound | United Kingdom | |

|---|---|---|

| Base Salary (per month) | ||

| Local employer’s cost | ||

| Total Cost (Annual) | ||

| Total Cost (Monthly) |

We guide you through 5 simple steps

Our latest insights

Beyond EOR Additional services to accelerate your growth

We support across every part of your global expansion journey – meaning we are uniquely placed to provide agnostic guidance about what is best for your business

Talent Acquisition

Find, hire & onboard the highly skilled team members you need in each locality.

Read more

Salary Benchmarking

Identify and prioritize markets for growth based on talent, cost & regulations

Read more

Market Selection Advisory

Compare available talent, compensation, additional costs and regulations across different countries

Read more

Entity Setup

Establishing & incorporate business entities overseas, ensuring a smooth entry into new markets

Read more

Frequentlyasked questions

An Employer of Record (EOR) is a global employment solution that allows businesses to hire talent in new markets without setting up a foreign subsidiary or entity. The EOR becomes the official employer under local employment laws, managing global payroll, employee benefits, tax withholding, and compliance management.

Companies typically use an EOR when:

Entering new markets quickly without creating a local In-Country partner or subsidiary.

Hiring a distributed company workforce compliantly across multiple countries.

Avoiding compliance risk management issues such as labor law breaches or contractor misclassification.

This makes the EOR model a cost-effective pathway for global expansion and long-term global workforce strategy.

With an EOR, you retain day-to-day control while the provider ensures legal and HR compliance. The process includes:

Issuing a locally compliant employment agreement or contract.

Managing employee onboarding including Form W-4, NI Number (National Insurance Number), and other country-specific registrations.

Handling global payroll, cross-border payments, currency exchange, and cutoff date payroll deadlines.

Providing statutory employee benefits such as auto-enrolment pension scheme, Provident Fund (PF), or Central Provident Fund (CPF) depending on location.

This ensures smooth onboarding, accurate gross to net payroll, and long-term employee retention.

Entity setup can take months and require complex international tax compliance. An EOR eliminates this by:

Hiring in new markets within 2–4 weeks with proper work permits, employment pass, or S Pass visas where required.

Managing expatriate management and visa sponsorship for international hires.

Ensuring compliance risk management with local international labor laws and UAE Labour Law, working time directive, or Fair Consideration Framework (FCF) in different jurisdictions.

This makes the EOR model ideal for testing markets, building FTE (Full-Time Equivalent) teams, and scaling quickly.

An EOR shields companies from tax compliance and labor law risks by:

Drafting compliant employment agreements and handling notice periods, severance pay, redundancy rights, and end of service gratuity.

Ensuring accurate payroll audit and post-tax deductions such as TDS (Tax Deducted at Source), PAYE, or Professional Tax.

Avoiding 1099 employee and Form 1099-NEC misclassification risks by offering proper W-2 Employee or salaried employee status.

Managing Data Processing Agreements (DPA) and GDPR (General Data Protection Regulation) compliance for employee data.

This significantly reduces penalties, disputes, and liabilities during global expansion.

Yes. An EOR can manage both salaried employees and independent contractors. For employees, the EOR issues complaints about employment agreements, manages global payroll, pay stubs, social security wages, and leave management. For contractors, the EOR ensures correct invoicing, Form 1099-MISC/Form 1099-NEC, and cross-border payments via SWIFT or local channels.

This dual approach enables a flexible global talent acquisition and workforce analytics strategy while ensuring international tax compliance.

Employing Internationally?

Learn more about the countires you want to employ in, their employment law, local benefits and more