Trusted by over 1500 companies to pay employees in over 130 countries

Beyond a payroll serviceA globalization accelerator

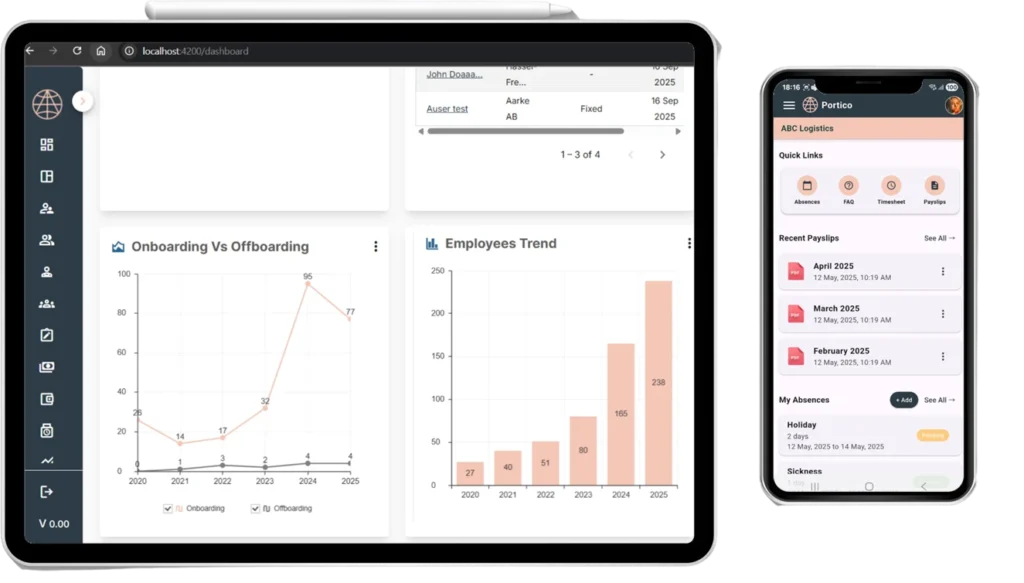

Payroll platform

Global payroll simplified

Your intuitive hub for paying global teams. Simple, powerful, and designed to scale with you — no complexity, just clarity.

Audit

Eliminate barriers to growth

Avoid compliance issues across your global workforce and uncover opportunities to improve profitability. On a quarterly basis we’ll help you audit your global talent strategy to ensure it aligns with your business goals.

Intelligence

Build a data-driven talent strategy

Grow confidently and profitably with access to the latest TopSource insights & data on hiring markets, salary benchmarking & benefits.

Advisory

Expert guidance that turns complexity into clarity.

Whether you’re managing a global acquisition or entering a new market, you get clear guidance to navigate complex decisions, avoid delays, and accelerate your global expansion.

Global Employee Cost Calculator

Estimate the cost of your new hire with our calculator. Simply enter their location and salary information in to this handy tool to see what will be spent in employment costs each month.

Employment Cost Calculator

United Kingdom

| British Pound | United Kingdom | |

|---|---|---|

| Base Salary (per month) | £2,913.58 | £2,913.58 |

| Local employer’s cost | £384.88 | £384.88 |

| Total Cost (Annual) | £39,581.54 | £39,581.54 |

| British Pound | United Kingdom | |

|---|---|---|

| Base Salary (per month) | £2,913.58 | £2,913.58 |

| Local employer’s cost | £384.88 | £384.88 |

| Total Cost (Annual) | £39,581.54 | £39,581.54 |

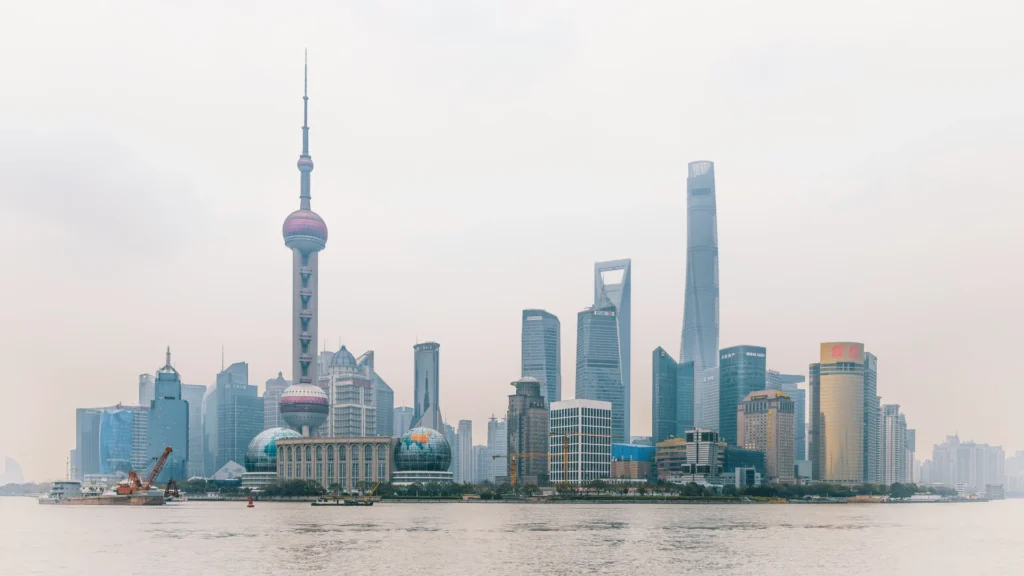

Pay employees all around the world

Learn more about our payroll services in the countries you want to employ in.

Beyond payroll. A range of services to fuel your growth.

We support across every part of your global expansion journey – meaning we are uniquely placed to provide agnostic guidance about what is best for your business

Global Mobility & Immigration

Support with employee relocation, immigration, and assignments across international borders.

Read more

Entity Setup

Establishing & incorporate business entities overseas, ensuring a smooth entry into new markets

Read more

Entity Management

Management of your business entities’ compliance, governance, and recordkeeping.

Read more

Frequentlyasked questions

Fully managed global payroll is an end-to-end solution that consolidates salaries, employee benefits, and tax obligations across multiple countries into one system. Unlike local providers who only manage payroll under specific labor laws, a global provider like TopSource offers compliance management, supports cross-border payments, and ensures consistency across jurisdictions. This approach simplifies multi-country payroll, reduces compliance risk management issues, and aligns with your broader global workforce strategy.

Our payroll services are designed around strict international tax compliance and employment laws. We align with statutory obligations such as social security wages, provident fund (PF), ESIC, or the central provident fund (CPF) in Singapore. Local experts monitor labor law changes and update filings, ensuring accuracy in tax compliance, auto-enrolment pension schemes, and reporting. This reduces the risk of penalties and improves employee retention by ensuring timely and lawful payments.

With Topsource, CFOs and HR leaders gain access to workforce analytics dashboards showing gross to net payroll, headcount, and compliance data across countries. Reports can be consolidated into one currency for easier currency exchange management and linked with general ledger systems. Leadership can drill down by entity, cost center, or foreign subsidiary, giving full visibility into payroll data processing agreements (dpas), compliance checks, and payroll audit trails.

Yes, we process salaries for salaried employees, 1099 employees, and contractors across 150+ currencies. Using SWIFT networks, we support cross-border payments, local statutory contributions, and even end of service gratuity payouts in countries like the UAE under UAE labour law. We also handle currency exchange and ensure payments meet local wages protection system (WPS) requirements, reducing treasury complexity and improving employee trust.

Our platform integrates with major HR and ERP systems such as workday, oracle, and netsuite. By syncing payroll with global HR (human resources) tools, we eliminate manual input, ensure employment agreement data flows correctly, and simplify employee onboarding. This also connects pay stub details, P45/P60 forms, and form W-4 records directly into finance workflows, reducing payroll audit risks and supporting compliance with GDPR (general data protection regulation).