Ultimate Employment Guide to Hiring in Germany

Payroll

Payroll in Germany

Employers are responsible for calculating gross-to-net pay, withholding income tax (Lohnsteuer), & remitting social security contributions.

Frequency & Setup

- Payroll cycle is typically monthly as standard.

- Employers must register with tax & social insurance authorities before the first payroll run.

- Employers must issue payslips showing statutory deductions & employer contributions.

Employer Responsibilities

- Withhold wage tax based on employee tax class.

- Withhold social insurance contributions (e.g. health, pension, unemployment, etc).

- File monthly declarations (via ELSTER/DEÜV).

- Comply with min wage and payroll record-keeping.

Taxes

Employer Tax Obligations in Germany

In Germany, employers handle income tax withholding and social security contributions.

Income Tax (Lohnsteuer)

- Calculated using progressive tax rates based on employee earnings and tax class.

- Remitted monthly to local tax offices.

Reporting & Compliance

- Monthly reporting of tax and social contributions is mandatory.

- Annual wage tax certificates must be submitted and provided to employees.

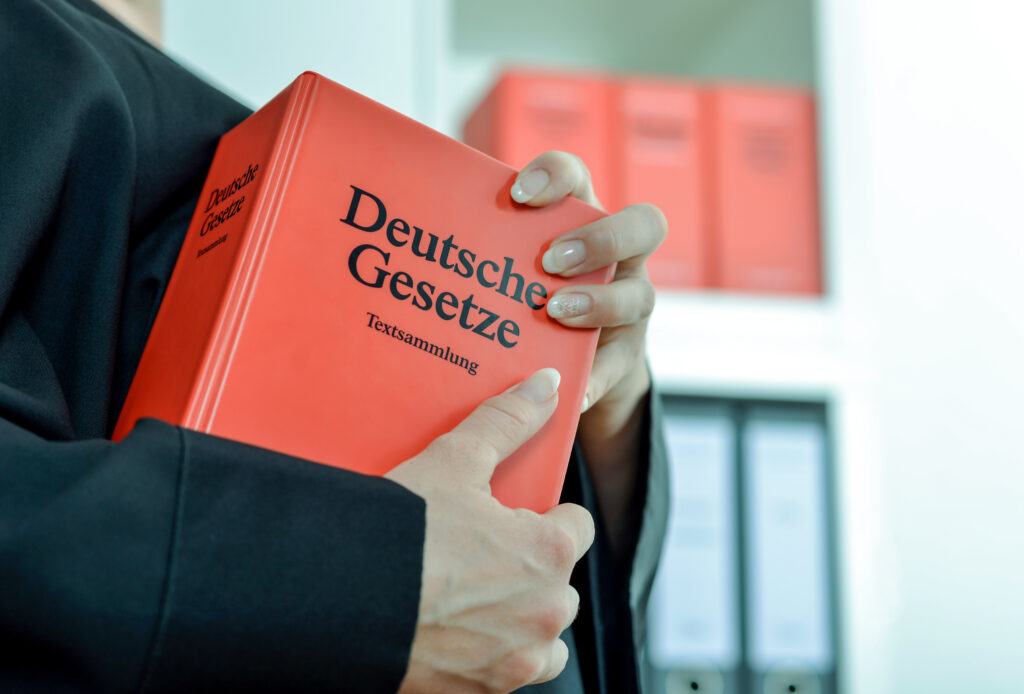

Termination

Legal Landscape German employment law strongly protects employees and requires properly documented procedures for termination. Notice Periods

- Statutory notice periods increase with employee tenure.

- In many cases, at least four weeks’ notice is required, but longer periods apply for long-service staff.

- Termination must be objectively justified (e.g., operational, performance, or conduct reasons).

- In companies with >10 employees and >6 months’ service, termination protection laws apply.

Time off

Statutory Time Off

Annual Leave Under the Federal Vacation Law, employees are entitled to a minimum of 24 working days of paid annual leave (based on a 6-day week; usually interpreted as 20 days for a 5-day week), with many employers offering more. Public Holidays Public holidays vary by federal state (e.g., 10–13 days per year). Employees are typically paid for these days if they fall on a normal working day. Sick Leave Employees can receive full pay for up to six weeks per illness when medically certified. After this, statutory health insurance can pay a portion of wages. Parental Leave Parents are entitled to up to 3 years of parental leave per child, with job protection and flexible arrangements.

Benefits

Mandatory Statutory Benefits Employers must ensure employees are covered by statutory social security:

- Health insurance

- Pension insurance

- Unemployment insurance

- Long-term care insurance

- Accident insurance

- 13th-month pay/holiday bonuses (Weihnachtsgeld, Urlaubsgeld), especially under collective agreements.

- Enhanced pension plans

- Employee wellness programs

- Offering competitive benefits supports recruitment and retention, especially in competitive sectors.

Onboarding

Contract & Documentation

- Written employment terms must be provided within one month of hiring.

- Contracts should include essential terms and comply with German labor law.

- Register employees with social insurance authorities before they begin work.

- Register for payroll tax withholding with the tax office.

- Probation periods up to 6 months are common.

- Collect necessary bank details and tax information (e.g., tax class).

Additional Considerations

Employment Contracts & Flexibility German employment contracts are typically formal and detailed, and cannot easily include unilateral policies — deviations from statutory rights must be compliant. Works Councils & Collective Bargaining In many workplaces, employee representation (works councils) and collective agreements impact terms and conditions. Employer Risk Areas

- Misclassification of workers (employee vs contractor) carries penalties.

- Failure to properly report taxes or social contributions can lead to fines.

Calculate payroll costs in Germany

Discover the full costs associated with employing and paying team members in Germany

Employment Cost Calculator

*Indicative figures only and not definitive legal advice. Local regulations change frequently. Consult an expertUnited Kingdom

| British Pound | United Kingdom | |

|---|---|---|

| Base Salary (per month) | ||

| Local employer’s cost | ||

| Total Cost (Annual) | ||

| Total Cost (Monthly) |

German Employer Contracts & Onboarding

Employment Contracts

- Employers must issue written employment terms before work begins.

- From Jan 2025, digital delivery of employment documentation is permitted (except certain sectors like construction). (Nachweisgesetz update.)

Compliance Obligations

- Provide written employment terms (digital allowed where permitted).

- Register employees with Germany’s social security authorities before their first working day.

- Maintain payroll, working time and leave records (audit proof).

- Respect collective bargaining agreements and works councils where applicable.

- Arrange occupational accident insurance (Berufsgenossenschaft).

- Ensure payroll systems reflect current wage rates and tax/social rules.

Germany Work Visas and Employee Relocation

Immigration and Work Visas in Germany

Employing or relocating staff to Germany requires compliance with German immigration and work visa regulations. Employers must ensure that non-EU employees have the correct work authorisation in place before starting employment.

EU, EEA, and Swiss nationals can work in Germany without a visa. Non-EU employees typically require a residence permit with work authorisation, most commonly through the EU Blue Card for skilled professionals. Work visas are usually linked to a specific role, employer, and minimum salary level.

Processing times and requirements vary, making early planning essential when relocating staff to Germany. Employers are responsible for right-to-work checks and maintaining valid documentation. Many companies choose professional visa and immigration support to manage applications, ensure compliance, and support a smooth relocation for employees moving to Germany.

Minimum Wage, Sick Pay & Parental Leave in Germany

Minimum Wage & Pay Frequency

- Minimum wage (2025): €12.82 / hour (≈ €2,161 / month). (MiLoG.)

- Salaries are typically paid monthly, by the last working day of the calendar month.

Sick Pay

- Employer pays 100% salary for up to 6 weeks if sick with medical certificate.

- Thereafter statutory health insurance pays up to 70% of gross salary for up to 72 weeks (subject to rules).

Maternity & Parental Leave

- Maternity: 6 weeks before and 8 weeks after childbirth (longer in special cases). Employer is reimbursed for maternity pay by health insurance.

- Parental leave: up to 3 years per child; can be taken by either parent and split until the child’s 8th birthday.

13th Month pay for German employees

13th month pay (Christmas Bonus) in Germany

In Germany, employers often provide additional benefits such as Weihnachtsgeld (Christmas bonus) and Urlaubsgeld (holiday bonus), which together are sometimes referred to as 13th-month pay or 14th-month pay. However, it is important for employers to understand that these payments are not legally mandated under federal law. Their application depends on specific employment contracts, company policies, or collective bargaining agreements (CBAs). These bonuses are part of broader employer contributions in Germany and reflect how organizations manage competitive compensation practices when hiring in Germany while maintaining employer compliance with labor standards.

- Respect collective bargaining agreements and works councils where applicable.

- Arrange occupational accident insurance (Berufsgenossenschaft).

- Ensure payroll systems reflect current wage rates and tax/social rules.

Germany Payroll: Social Security, Taxes, and Employer Costs

The costs for health insurance, nursing care insurance, pension insurance, and unemployment insurance in Germany are split equally between the employee and employer, reflecting the country’s structured social security system. However, accident insurance premiums are fully employer-funded and paid annually to the Berufsgenossenschaft (Germany’s statutory accident insurance association). These contributions form a key part of employer compliance in Germany and should be factored into total payroll costs when hiring in Germany.

Statutory Employer Contributions – (2025)

| INSURANCE TYPE | EMPLOYER RATE | FUNDING DETAILS |

|---|---|---|

| Health insurance | 7.3% | Shared with employee. |

| Additional healthcare contribution | 1.25% | Shared with employee; varies by health insurer. |

| Long-term nursing care insurance | 1.8% | Shared with employee. |

| Pension insurance | 9.3% | Shared with employee. |

| Unemployment insurance | 1.3% | Shared with employee. |

| Accident insurance | Fully Employer-Funded | Paid annually to the “Berufsgenossenschaft” in Germany. |

Contribution Assessment Ceilings (2025)

- Pension & Unemployment: €8,050/month (€96,600/year)

- Healthcare & Nursing Care: €5,512.50/month (€66,150/year)

Earnings above these thresholds are exempt from further social security contributions.

Other Nominal Employer Levies

- U1 levy (sickness continued payment) — varies by health insurer

- U2 levy (maternity continued payment) — varies by health insurer

- Insolvency insurance

Public Holidays and Employment Regulations in Germany

Public holidays in Germany are a key element of the country’s employment laws and HR regulations. Unlike many nations with a standardized list of national holidays, Germany’s employment regulations combine both federal and state-level observances. As a result, the number and type of public holidays in Germany vary depending on the state where employees work—for example, Bavaria has more recognized holidays than Berlin.

Under the German Working Time Act, employees are generally entitled to a paid day off on public holidays. When business operations require work on these days, employers must provide substitute rest periods and follow all employment law compliance requirements. HR professionals and employers hiring in Germany should track holiday entitlements by location, ensure that employment contracts reflect the correct state-specific rules, and plan workforce scheduling accordingly.

Properly managing public holidays and employment regulations in Germany is not only a matter of legal compliance but also an important part of maintaining employee satisfaction and ensuring fair, transparent workplace practices.

| Date | Holiday | State |

|---|---|---|

| 1 Jan | New Year’s Day | All |

| 6 Jan | Epiphany | Baden-Württemberg, Bavaria, Saxony-Anhalt |

| 18 Apr | Good Friday | All |

| 21 Apr | Easter Monday | All |

| 1 May | Labour Day | All |

| 29 May | Ascension Day | All |

| 9 Jun | Whit Monday | All |

| 19 Jun | Corpus Christi | Baden-Württemberg, Bavaria, Hesse, NRW, Rhineland-Palatinate, Saarland, parts of Saxony & Thuringia |

| 15 Aug | Assumption Day | Bavaria (Catholic areas), Saarland |

| 3 Oct | German Unity Day | All |

| 31 Oct | Reformation Day | Brandenburg, Mecklenburg-Vorpommern, Saxony, Saxony-Anhalt, Thuringia, Schleswig-Holstein, Hamburg, Bremen, Lower Saxony |

| 1 Nov | All Saints’ Day | Baden-Württemberg, Bavaria, NRW, Rhineland-Palatinate, Saarland |

| 19 Nov | Repentance Day | Saxony |

| 25 Dec | Christmas Day | All |

| 26 Dec | Boxing Day | All |

Our employment services for Germany

Your first step – talk to us to help you easily employ teams in Germany or to establish and manage entity.

Talent Acquisition

Find and hire the talent your business needs in Germany.

Benefits Benchmarking

Benchmark benefits and compensation against other global and Germany based companies

Read more

Learn about other markets

We help organizations with employ and pay teams in over 180 countries. Learn about other markets, their employment laws and common HR practices.

Frequently Asked Questions About Hiring in Germany

Severance pay is not automatic by law, but it’s often negotiated, especially in cases of redundancy or collective agreements. A typical guideline is half a month’s salary per year of service, but exact amounts depend on the case.

While contractors allow fast market entry, misclassification is a major risk. If a contractor is found to be working as an employee in practice, the employer could face fines, back taxes, and liabilities. Using a compliant employment model helps mitigate this risk.

On top of gross salary, employers usually contribute 20–22% toward social security, which covers pension, health, unemployment, and long-term care. These contributions significantly affect the total cost of employment, making careful payroll planning essential.

Yes, full-time employees are legally entitled to a minimum of 20 paid vacation days per year, based on a 5-day work week. In practice, most employers offer 25–30 days as part of a competitive benefits package. Sick leave and parental leave are also strongly protected.

As of 2025, the statutory minimum wage is €12.82 per hour (around €2,161 per month). Employers must comply under the Minimum Wage Act (MiLoG).

The probation period is up to six months. During this time, a two-week notice can be applied for termination.