Running payroll for your employees is no mean feat, and keeping up with the ever-changing legislation can make an already-critical task even more challenging and complex. This is especially true for smaller businesses, where business owners must wear a dozen hats to keep the cogs turning.

There’s no need to manually handle payroll calculations, admin activities and keep track of data on your own, though. Payroll outsourcing is the modern-day solution for businesses that can help reduce payroll-related stress and simplify your processes.

But how can you find the right payroll service provider to mitigate the classic challenges associated with running payroll?

What are the challenges of payroll outsourcing?

Before you go searching for the perfect payroll provider, it’s important to understand some of the typical payroll challenges businesses face. Knowing these key issues can help you evaluate factors that are important for your organisation, making it easier to find the right company to manage your payroll.

Cost control

Controlling the cost of payroll outsourcing is a crucial challenge. While payroll outsourcing should cost less as you’re not hiring an entire team, hidden charges can ruin your experience.

Control over processes

There are a lot of processes in payroll. And many businesses fear that outsourcing payroll will mean losing control over these processes. This can be true — but only with the wrong provider. With the right provider, you’ll have clear visibility of and be involved in the entire process, allowing you to maintain control of your payroll department.

Data security

Another major bottleneck in outsourcing is data security. Data privacy and security depend on the provider’s awareness of the various data security risks, its infrastructure and its ability to keep the server containing your sensitive data secure.

Remote communication

Remote communication can be difficult for any team. Fortunately, the recent pandemic has taught us all how to be more efficient and productive when working remotely. A good payroll provider will be well equipped with the appropriate tools to communicate remotely without any glitches.

What to look for in a payroll company

Most of these payroll outsourcing challenges can be mitigated by handing the task over to an expert full-service payroll team. However, to ensure you choose the right payroll service provider, it’s important to keep these factors in mind when searching…

Accuracy

When outsourcing your payroll tasks, you need to ensure the provider has the expertise and skills for accurate calculations. After all, what’s the point of spending money on a service that’s still sending the wrong payments to your employees? As such, accuracy should be the first thing you check for.

Customer reviews and references

To get an overview of a provider’s services, check out their online reviews. This includes searching in places like Google Reviews, Glassdoor, Trustpilot, their website and social media platforms. Here, you need to review the rating and number of ratings (a five-star rating is great, but not if it’s based on only one review), as well as both negative and positive feedback.

Another great way to collect feedback about your provider is to ask for customer references that you can reach out to. References give you direct and first-hand feedback about the services, accuracy, flexibility and overall customer-centricity of the service provider.

Customised packages

You might think a basic package or subscription-based model will be fine for your business, and it probably will be — for now. However, as your business grows, your payroll and compliance needs may increase. When that happens, chances are you’ll need a customised payroll services package.

If your provider doesn’t offer you that, you may have to go through all the hassle of searching for and onboarding another payroll service provider again. As such, it’s essential to choose a payroll provider that’s willing to offer you a customised package from the start.

Subject matter expertise

An experienced provider will have a whole team of subject matter experts who can handle a range of payroll tasks, including payroll calculations, taxes, deductions and other requirements.

The easiest way to evaluate this expertise is through a detailed demo of the provider’s services with all your stakeholders involved in the process. An onsite visit to look at the provider’s office infrastructure and meet their payroll team directly will give you a good insight into their capabilities and skillsets.

Convenience

When you outsource your payroll, you don’t want your HR team having to contact the provider with every query or for every little detail. To eliminate this issue, be sure to choose a provider that offers convenient services, such as HR logins and employee self-service portals. These services allow employees to check basic information without guidance. For example, employees can download payslips, and HR can see the salary dispatch status.

Legacy data management and data security

Payroll data is highly sensitive; it’s personally identifiable information, which should be secured on servers and during online transactions. When choosing a payroll service provider, you want to be sure they have stringent data security policies, infrastructure and a secure payroll management system in place.

Your payroll provider should backup your data for worst-case scenarios and contingency planning. And at the time of onboarding, any experienced provider should also help you migrate your legacy data.

Statutory compliance

Payroll legislation is complicated, with many rules and regulations to ensure security, accuracy and compliance. To keep your payroll error-free, it’s vital to choose a payroll provider with expertise in regulatory compliance, tax compliance and data privacy compliance.

What no one tells you about outsourcing your payroll

When using a service for the first time, you don’t want any surprises. So, here are a few things no one tells you about outsourcing your payroll processes that you absolutely should know…

One size doesn’t fit all

Your organisation’s requirements could be completely different from the standard package offered by the payroll company. So, ask for a customised package and pay only for the services you’ll be using!

Employee support is imperative

When it comes to outsourcing your payroll, you need support from your employees. Even when adopting new tech or using a new tool, your employees need to be able to adapt to it to improve business productivity. Similarly, you need to prepare your employees for this shift to using a payroll outsourcing company. So, always check whether your provider offers training and documentation to your employees as part of the implementation.

Industry expertise matters

Subject matter expertise is vital — but so is industry expertise. Payroll varies from sector to sector; if you can find a payroll provider in your industry, it’ll be a significant advantage. This industry expertise will allow your provider to help you with industry-specific payroll regulations, laws and best practices.

Global operations are a plus

Every company scales, meaning your business may eventually operate worldwide. When you scale globally and hire international employees, a provider with a global presence or experience can help you ensure the whole process goes smoothly and keep on top of varying payroll requirements in each region. So, finding a payroll provider with a global footprint is always an added bonus.

Finding the right payroll provider will enable you to outsource your payroll requirements without worrying about accuracy, data privacy and compliance. TopSource Worldwide is a fully managed payroll service provider with dedicated payroll teams around the world — offering local and global payroll in over 100 countries. Get in touch at sales@topsourceworldwide.com to see how we can help.

Save this article in PDF

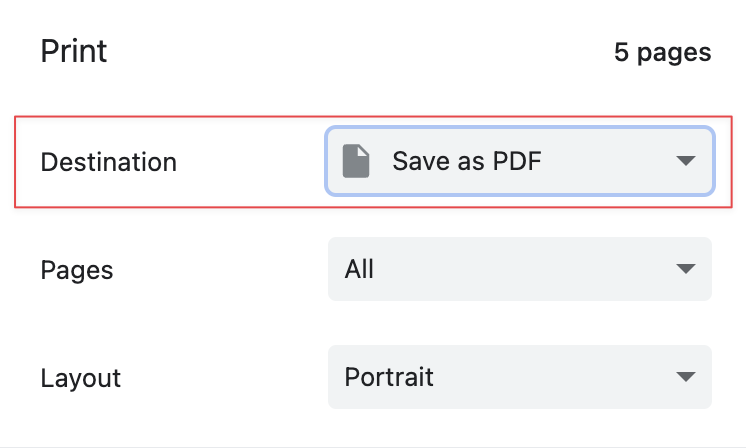

Click the Print to PDF button below and then pick the Save as PDF option from the Destination select, if not already selected.

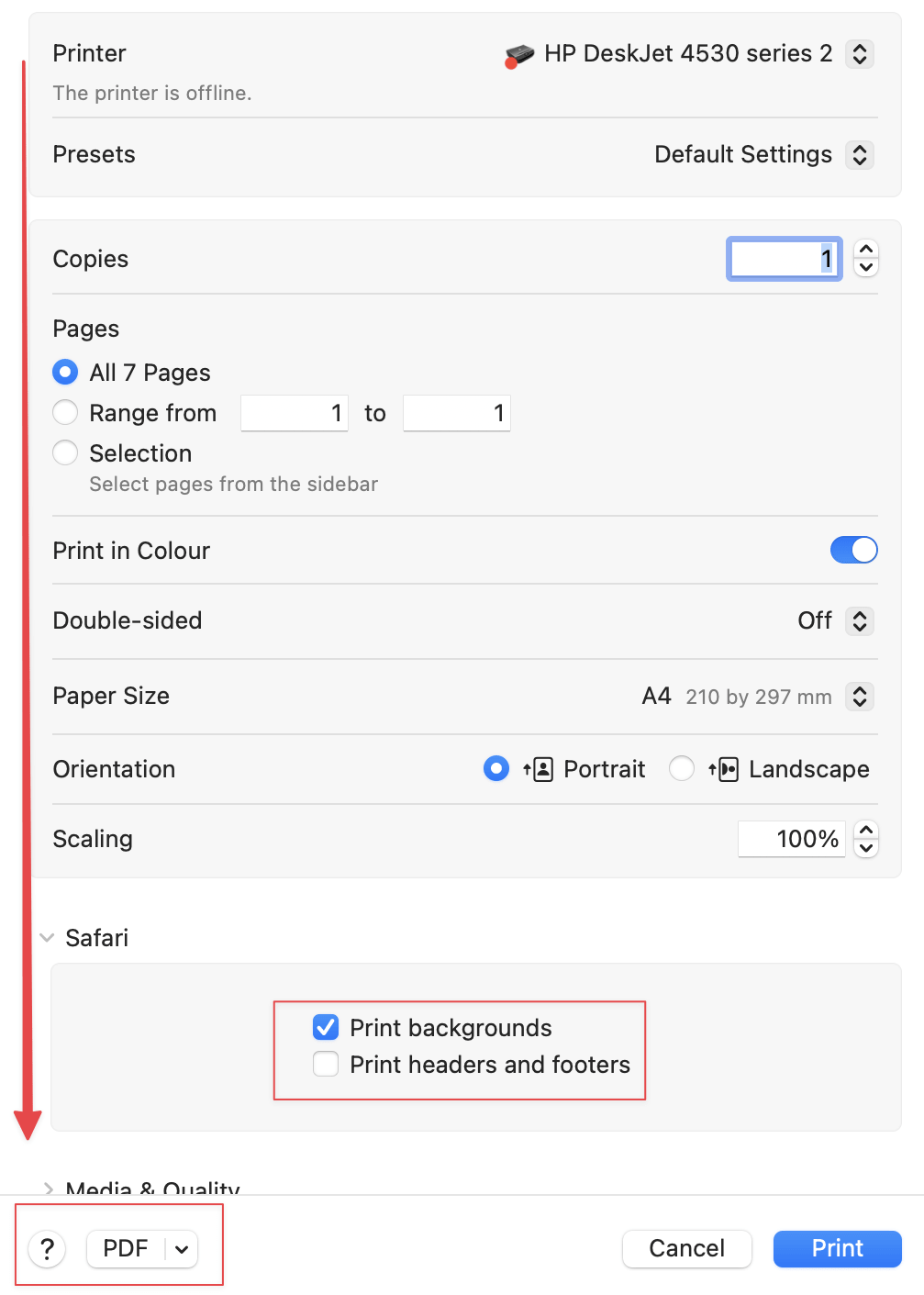

Click the PDF button right at the bottom left side of the window. It is also recommended to check the Print backgrounds option and uncheck the Print headers and footers for a better viewing experience.