Employment laws differ from country to country, and payroll laws are no different. With all their quirks and nuances, it can be easy to miss things in your global payroll operations when your business spans multiple jurisdictions.

For any business looking to expand into ‘old Blighty’, here are several important UK payroll process laws you simply have to know when operating in the United Kingdom

The UK's established payroll system

Salary in the UK is paid in 12 equal instalments throughout the year. Typically, salaried workers are paid directly to their bank account each month.

In the UK, paying your employees takes place through Her Majesty’s Revenue and Customs (HMRC) and the Pay-As-You-Earn (PAYE) system — even if you only have one employee. Once you’ve registered as an employer, you can run payroll in the UK yourself or outsource it to a payroll services provider in the UK.

HMRC and PAYE considerations for your UK payroll process

As an employer registered for PAYE, you’ll have various responsibilities to ensure compliance — even if you’ve outsourced your payroll. Other PAYE requirements include:

- Recording payments of your employees' wages

- Creating payslips for each worker, and

- Administrating national insurance contributions for every employee

It’s essential to submit relevant payroll information to HMRC on the day before you pay your employees, thanks to the UK’s Real-Time Information (RTI) system. To file this information, businesses must make a full payment submission (FPS) — a report that most payroll software will generate and submit for you.

What’s more, if your business has an auto-enrolment pension scheme in place, your employees’ pension contributions must be factored into their pay, too.

Unlike many other countries, the UK doesn’t have a 13th-month bonus pay rule, but employers can offer annual employee bonuses.

Tapping into taxes

UK employees are taxed on their income using a progressive tax system, with the first £12,500 of annual earnings being tax-free. Earnings between £12,501 and £50,000 are taxed at 20%, while earnings between £50,001 and £150,000 fall into the higher tax bracket of 40%. Anything over £150,000 is taxed at 45%.

PAYE also allows HMRC to collect National Insurance (NI) contributions. These contributions are payable at 13.8% of a worker’s gross monthly salary, less a monthly threshold.

What is the minimum Statutory Sick Pay in the UK (SSP)?

It’s no surprise that the UK’s sick pay policies have seen an overhaul in light of COVID-19. Currently, an employee must miss four consecutive days of work due to illness before any statutory sick pay begins to take effect (i.e., the first three working days are unpaid, but sick pay kicks in on the fourth day). Although employees are entitled to £109.40 in Statutory Sick Pay (SSP) each week for up to 28 weeks, many employers provide higher contractual sick pay.

If the illness is related to COVID-19, the three-day waiting period doesn’t apply, and employees are entitled to a week of SSP immediately.

What are the UK paid leave regulations?

The annual holiday entitlement for UK workers is 5.6 weeks, meaning those working a typical five-day week must receive a minimum of 28 days’ paid leave each year. Statutory entitled leave for part-time employees is determined on a pro-rata basis depending on the number of days worked each week.

What’s the minimum wage in the UK?

The National Living Wage (NLW) of £10.42 an hour applies to workers aged 23 and over. For any younger employees, the hourly rate for the NLW is calculated based on age. Employees aged 21 to 23 are entitled to 10.18; 18 to 21-year-olds are entitled to £7.49, and the minimum wage is £5.28 for employees aged 16 or 17.

In the UK, employers aren’t required to pay their workers for any overtime. However, an employee’s average pay for the total hours worked must never fall below the National Minimum Wage. Additionally, employees only have to work overtime if their contract explicitly states the same, and nobody can be forced to work more than 48 hours a week unless agreed in writing.

Summary

In summary, for an efficient and compliant UK payroll process, companies hiring staff in this jurisdiction need to:

- Register as an employer with the HMRC and submit their payroll information

- Register with the UK's Pay-As-You-Earn System to ensure necessary tax and National Insurance contributions are made

- Factor in and account for Statutory Sick Pay (SSP) policies

- Adhere to annual holiday entitlement policies

- Adhere to National Living Wage (NLW) rates

As part of our provision of total employer services, TopSource provides a dedicated UK payroll offering to all businesses looking to expand internationally. However, our expertise also spans across India payroll and global payroll. So, get in touch with us today to find out how we can help you streamline your UK payroll process.

*This blog has been updated to reflect 2023 changes to figures and percentages.

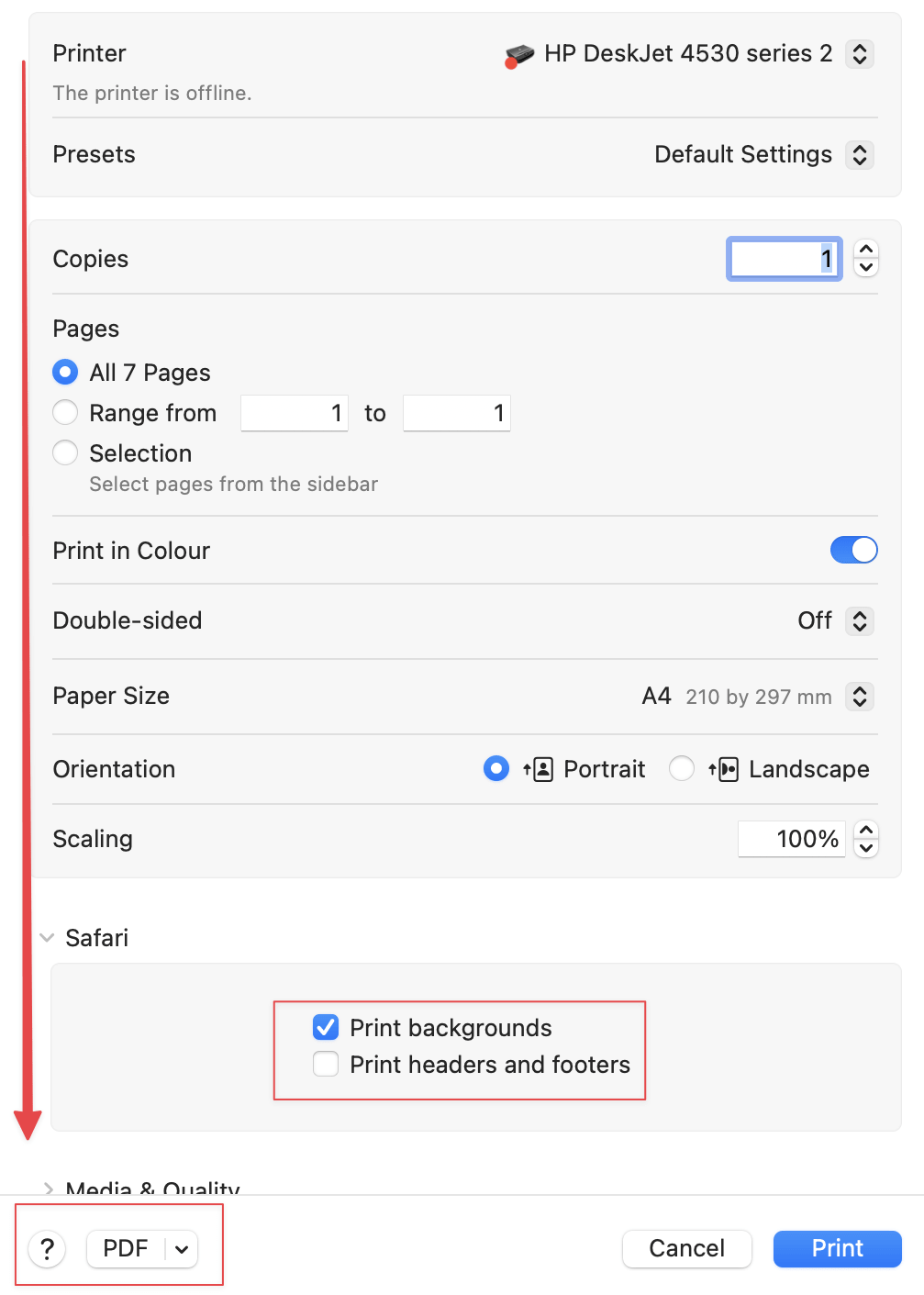

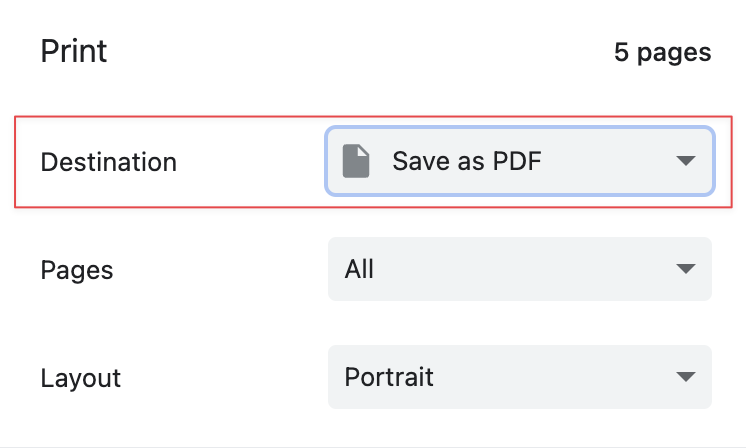

Print this article in PDF

Click the Print to PDF button below and then pick the Save as PDF option from the Destination select, if not already selected.

Click the PDF button right at the bottom left side of the window. It is also recommended to check the Print backgrounds option and uncheck the Print headers and footers for a better viewing experience.