Employee Cost Calculator

Hiring costs go beyond salary. Estimate the cost of your next hire with this calculator. Simply enter their location and salary information in to this handy tool to see what will be spent in employment costs each month.

Employment Cost Calculator

*Indicative figures only and not definitive legal advice. Local regulations change frequently. Consult an expertUnited Kingdom

| British Pound | United Kingdom | |

|---|---|---|

| Base Salary (per month) | ||

| Local employer’s cost | ||

| Total Cost (Annual) | ||

| Total Cost (Monthly) |

Other services

Accelerating your growth in India and beyond

TopSource goes far beyond payroll, acting as your end-to-end partner in global workforce management. From Employer of Record (EOR) services and seamless entity setup to localized accountancy and fractional HR support, we cover every aspect of international employment.

Meet our experts for India

Whether you’re entering the market or scaling operations, our specialists provide the insight and guidance you need to succeed in one of the world’s most dynamic and regulated employment landscapes. With TopSource, you’re backed by real experts, every step of the way.

Beyond a payroll serviceA globalization accelerator

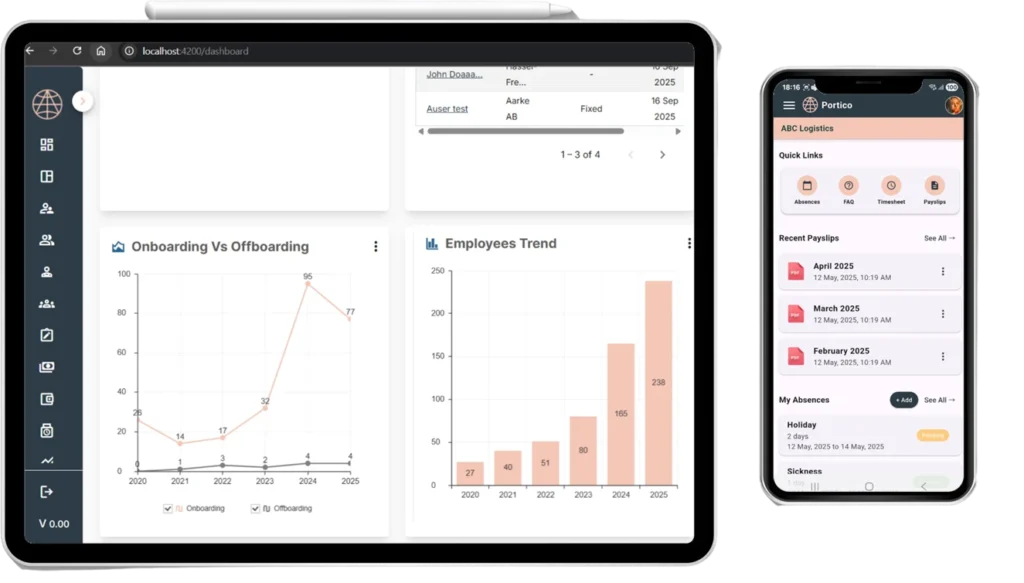

Payroll platform

Global payroll simplified

Your intuitive hub for paying global teams. Simple, powerful, and designed to scale with you — no complexity, just clarity.

Audit

Eliminate barriers to growth

Avoid compliance issues across your global workforce and uncover opportunities to improve profitability. On a quarterly basis we’ll help you audit your global talent strategy to ensure it aligns with your business goals.

Intelligence

Build a data-driven talent strategy

Grow confidently and profitably with access to the latest TopSource insights & data on hiring markets, salary benchmarking & benefits.

Advisory

Expert guidance that turns complexity into clarity.

Whether you’re managing a global acquisition or entering a new market, you get clear guidance to navigate complex decisions, avoid delays, and accelerate your global expansion.

Looking at other markets too?

We help organizations with employ and pay teams in over 180 countries.

Global payroll: frequently asked questions

Payroll is the process by which a company calculates and distributes wages to its employees. It involves determining gross pay based on hours worked or salary, deducting taxes and other contributions, and paying the remaining amount to employees. Payroll also includes complying with legal requirements, submitting reports to tax authorities, and maintaining accurate financial records. It can be managed internally or outsourced to specialized providers.

A payroll provider is a company or service that manages payroll on behalf of other businesses. They handle tasks such as calculating employee pay, processing tax deductions, issuing payments, and ensuring compliance with local employment laws. Payroll providers help reduce administrative burden and minimize the risk of errors or legal issues, especially when managing payroll across multiple regions or countries.

Payroll compliance laws are rules that govern how businesses must handle employee pay, tax deductions, and reporting. These regulations vary by country and often cover areas like income tax, social security, minimum wage, overtime, and statutory benefits. Staying compliant means accurately calculating payroll, meeting deadlines, and making correct payments to both employees and government bodies.

To find the right global payroll provider, consider their ability to operate in all the countries where you employ staff, their compliance expertise with local tax and labor laws, and their capacity to handle multiple currencies and languages. Look for providers with strong technology platforms, transparent pricing, and expert in-country support. It’s also important to assess whether they offer Employer of Record (EOR) services if you need help hiring in countries where you don’t have a legal entity.